Empirical analysis of survey responses demonstrate that iGaming and land-based gaming serve different, complementary purposes

167 page study finds land-based gaming businesses in Maryland, Illinois, New York, Louisiana, and Virginia would see hundreds of millions in new revenue due to iGaming passage

This is the second detailed economic study in two months to show how iGaming has boosted the retail gaming industry in legal iGaming states

Today, the Sports Betting Alliance unveiled a comprehensive study conducted by economists with Analysis Group, Inc. (“Analysis Group”). The 167-page study is the first iGaming research to incorporate consumer survey data and robust economic and statistical methods to evaluate data from all six iGaming states and make projections for five new states. This study shows that iGaming and land-based gaming serve different, complementary purposes.

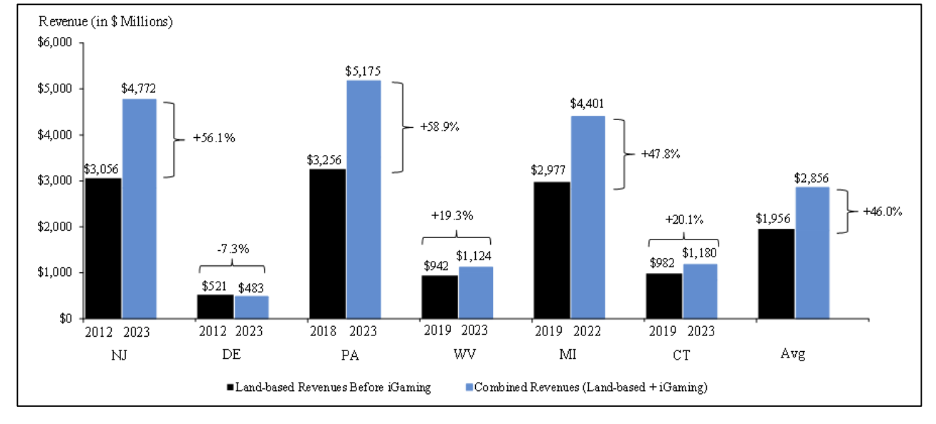

The study, “The Potential Economic Impact of Legalizing iGaming on Casino Revenues in Five States (New York, Illinois, Louisiana, Maryland, and Virginia),” found that land-based casino revenue growth rates increased by nearly two percentage points after the introduction of iGaming. It further found that total gaming revenue (online and land-based) in current iGaming states– New Jersey, Delaware, Pennsylvania, West Virginia, Michigan, and Connecticut– is on average 46 percent higher in 2023 than it was before those states implemented iGaming (see Fig. 1).

The study meticulously evaluated data from each state, providing details on the pre-existing trends in revenues before iGaming, the circumstances surrounding when iGaming was implemented, and the changes in trends after iGaming was implemented. As an example, land-based casino revenues in Pennsylvania were hovering around $3 billion dollars per year before iGaming. Since iGaming was implemented in 2019, even after the dramatic drop in revenues associated with COVID-19 in 2020 and 2021, land-based revenues recovered to their previous level and have grown faster than they were growing before iGaming (see Fig. 2, in grey and black). When accounting for the incremental revenues from iGaming, the total market in Pennsylvania has grown to over $5 billion (see Fig. 2, in blue).

The report also calculated how land-based and overall gaming revenue would be impacted by iGaming passage in five states currently considering legislation to do so. In Maryland alone, the study found that land-based casinos would see an additional $224 million in increased revenue growth thanks to iGaming passage. Both the iGaming and land-based casino market would grow in the five years after passage — from a combined $2 billion in revenue a year in 2024 to $3.9 billion in 2029 (a 91% increase). Similar results were found in the four other states studied: Illinois, New York, Virginia, and Louisiana.

This study is the second economic analysis in two months to show iGaming complements existing retail-casino businesses, with Eilers & Krejcik recently publishing a separate report similarly analyzing casino revenues and finding a boost to land-based casinos after the introduction of iGaming.

In addition to the economic impact analysis, the Analysis Group economists designed and conducted a survey of 2,389 current and prospective gaming consumers. The survey asked detailed questions on the consumers’ iGaming and retail gaming usage and preferences.

After investigating the data, the Analysis Group economists reported that “the majority of consumers who engage in iGaming indicate that they have not decreased their Land-based casino gaming activity (in terms of both visit frequency and total spend) after starting iGaming.”

In fact, more survey respondents reported that they have increased their land-based casino visitation frequency and budget after they began iGaming, indicating that iGaming is associated with increased demand for land-based gaming options (see Fig. 3 and 4).

The study systematically investigates the reasons behind consumers’ increased land-based gaming activity. According to the study, consumers see iGaming and land-based gaming as serving different and complementary purposes, with consumers engaging in iGaming more frequently as a casual, convenient option while continuing to visit land-based gaming options as part of a social experience that incorporates gaming and other entertainment activities.

A 36-year-old male interviewee from New Jersey explained how he engages differently with iGaming and retail casinos. In his words, when iGaming “I might throw like $50 into my account. I like to do little nickel-and-dime bets. You know, 5 bucks here or 10 bucks there […] as opposed to Atlantic City because when [I] go to a casino, I’m making a day out of it, you know? I mean, it’s more of a social event.”

Analysis Group is one of the largest international economics consulting firms, with more than 1,200 professionals across 14 offices in North America, Europe, and Asia. Since 1981, they have provided expertise in economics, finance, health care analytics, and strategy to top law firms, Fortune Global 500 companies, and government agencies worldwide. Their internal experts, together with their network of affiliated experts from academia, industry, and government, offer their clients exceptional breadth and depth of expertise.

Figure 1: Overall Market Expansion After States Implemented iGaming (in $ Millions)

Figure 1 Explanation: Total gaming revenue (online and land-based) in current iGaming states is on average 46 percent higher in 2023 than it was before those states implemented iGaming.

Figure 2: Pennsylvania Casino and VGT Revenues Before and After Legalizing iGaming,

2012–2023

Explanation Figure 2: Pennsylvania land-based casino revenues were stagnant around $3 billion dollars per year before iGaming was implemented in 2019. Even after the dramatic drop in revenues associated with COVID-19 in 2020 and 2021, land-based revenues recovered to their previous level and have grown faster than they were growing before. When accounting for the incremental revenues from iGaming, the total market in Pennsylvania has grown to over $5 billion.

Figure 3: Survey Results: Frequency of Land-based Casino Visits After iGaming

Figure 4: Total Spent in Land-based Casino Visits After iGaming

Explanation Figures 3 and 4: survey respondents reported that they have increased their land-based casino visitation frequency and budget after they began iGaming, indicating that iGaming is associated with increased demand for land-based gaming options.